Licensing Music in Asia

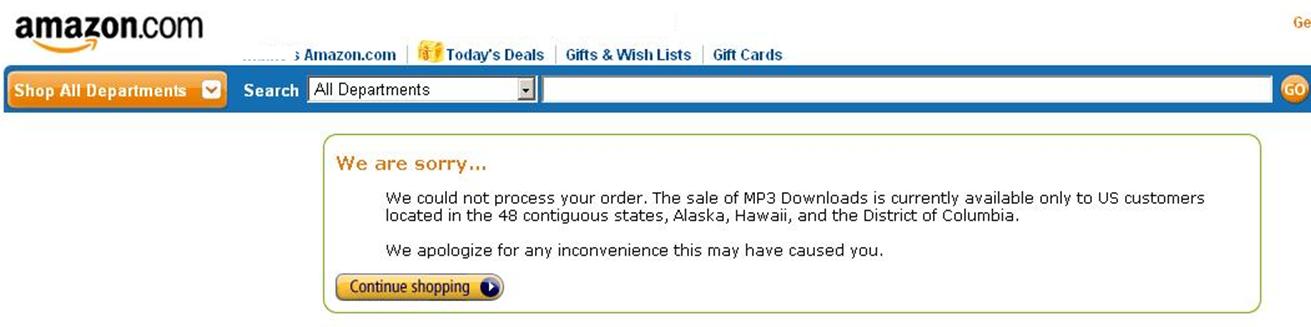

In this updated in-depth post on the approach to Licensing Music in Asia, the following is Part 2 of a two-part post which was first published on the MIDEMNet blog for MIDEM 2010 where I was a speaker. Alternative edited versions were also published by Canada’s TransmitNow and Interfax. Part 1 which can be read here, highlights the plight of Asian music consumers who are not only unable to conveniently access legal music but also cannot comprehend the music industry’s seemingly complex reasons for this ‘music apartheid’.

Asia is a complex beast that requires patience, investment and an understanding of socio-economic and, in some cases socio-political norms. It is thus imperative that labels and music retailers conduct the necessary due diligence and planning, in order to make an informed decision on licensing music in Asia as follows:

1) Asia is not just Japan… or Australia.

International artists, their agents and labels have a habit of promoting their music and playing in only Japan and/or Australia while bypassing most other Asian markets. Piracy in Asia, like anywhere else is a problem worth solving. Ignoring these markets or even restricting licensed access to music is not going to solve anything. In fact it will be the primary cause for increased unlicensed activity. Without the requisite investment of resources in comprehensive market development at every level (in particular live), it is likely that the majority of Western artists will be untroubled by piracy in Asia. This is particularly the case if the plan is to eventually develop these markets.

Failing to pay appropriate attention to these markets right now is an opportunity lost. In ignoring them, rightsholders fail to contribute to and cultivate the many growing music niches in Asia in a more active manner. Instead, train-wrecks like Britney fuelled by the global gossip news networks entrench themselves in Asian markets. Combine this market reality with the advent of hundreds of domestic artists that are also competing for the attention of local audiences and it will become increasingly difficult to get a foot in the door.

It is thus an ironical conundrum that the ‘luckier’ Western artists’ only exposure in the neglected Asian markets is sustained by the very same pirate networks that their respective labels condemn – while the rest languish in obscurity.

2) Provide not just access to content but context

The problem of piracy in Asia should not take sole precedence over that of artist obscurity. Licensing music to an online store is not enough. Labels have to also organize promotions and social network campaigns to reach out to a relevant target audience – or at least work with a promotion partner. For example, it is basic marketing sense that if an artist wants to reach out to Chinese audiences, there should at the very least be an artist website in Chinese as a focal point. Anything less is gross negligence. In addition, rich information about artists to provide historical and contemporary context should be made available. It is a stark illustration of the divide between understanding of Eastern and Western music consumption habits that many Asians want to have access to lyrics while listening to songs whereas Western labels and publishers are apathetic to its provision.

3) Understand music preferences and cultural norms

Find out what kind of music genres, languages of music consumed, types of music, local vs foreign music appetites etc are relevant country by country in Asia. For example in non-English speaking Asian countries, it is usually local language fare that dominates but there is also the possibility that this might be due to the lack of translated material for users. In China, genres that the Western music world are familiar with do not even have proper names in Chinese, much less the expectation that labels have of realizing sales on music in these genres.

4) Understand how music is consumed

Factors to consider with regards to the target market include technology usage, existing popular services and devices, formats, online/ mobile/ physical/ live, competing online activities etc

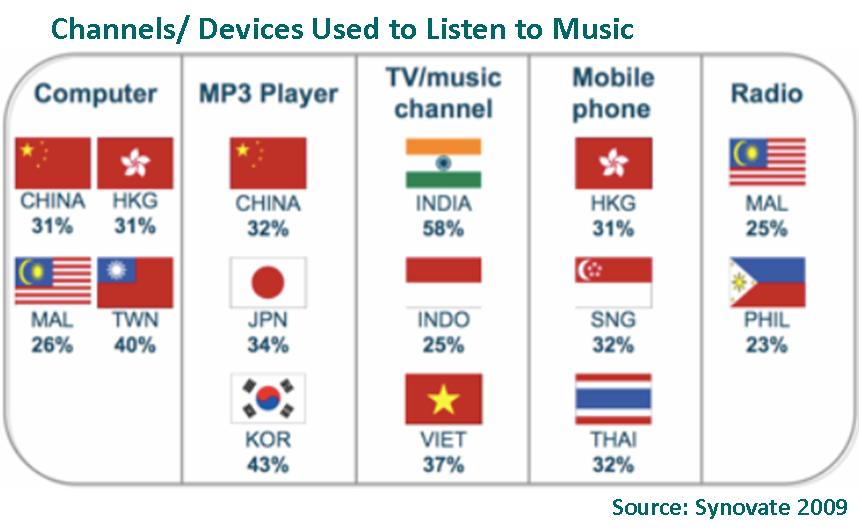

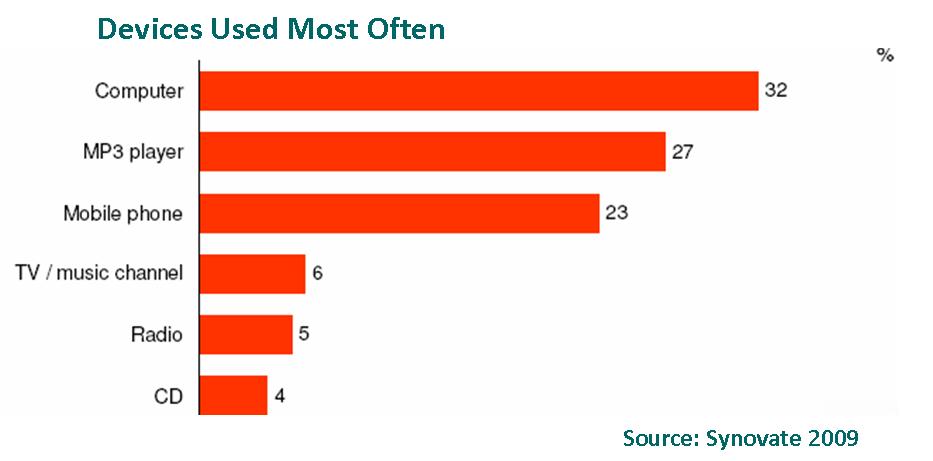

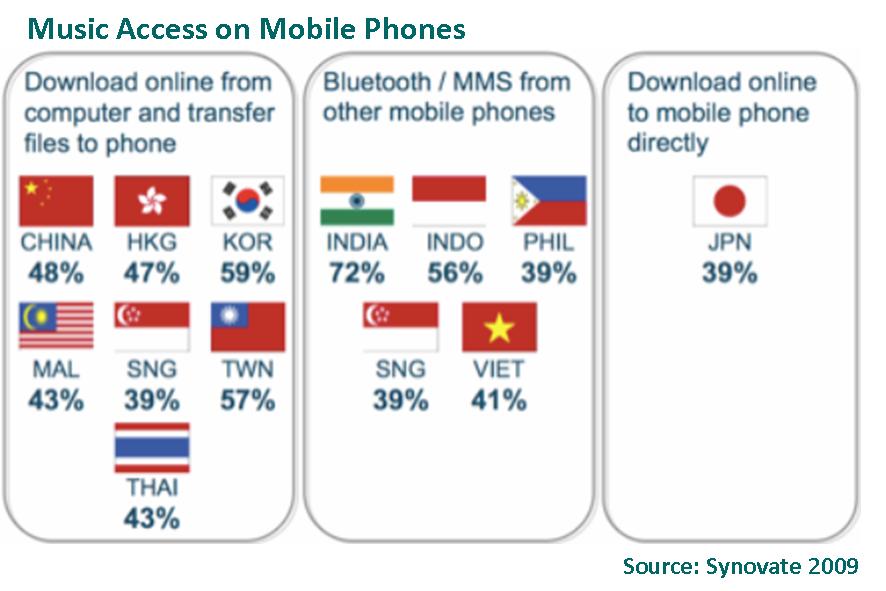

To illustrate the diversity in consumption habits in Asia, Synovate published a survey of more than 8,000 youths (aged 8-24) in 12 countries, and the following chart illustrates channel/ device usage for listening to music.

In general, the computer is the device used most often for listening to music

Overall, only 11% paid for music, and mainly via mobile. Even then, the cash cow of mobile music is being eroded as more users are side-loading from their computers and from unlicensed sources.

In each of these surveys we can assume that the ‘Computer’ is the elephant in the room and is a euphemism for P2P, BitTorrent and illegal music search engines that are the main vehicles used to download music in Asia.

5) Music pricing, payment mechanisms and revenue share rates

Cost of living and average salaries, consumer price Index, competing services’ pricing and piracy are all important factors to consider when defining pricing in the respective Asian markets. Instead some labels have tended to dictate retail prices to Asian digital retailers with reference to the USD 0.99 unit rate. Artist contracts that set their standard royalty at a fixed US dollar value per unit sold are unmindful of global marketing needs and myopically fail to accommodate currency differences and living standards around the world.

This has to be balanced with the fact that credit card take-up is low in large parts of Asia and local payment engines demand revenue shares that are much higher than that of credit card systems and can even go up to 30% of revenue.

Furthermore, in nascent markets, the retail partner has to invest an inordinate amount of resources but some foreign labels are sometimes still insistent on using the 70:30 revenue share rate that iTunes has arbitrarily decided in the US is the fairest one for them, knowing that their real revenues come from ancillary iPod sales. In Asia, with mobile carriers requiring between 15%-70% of revenue (depending on country) and mobile service providers requiring between 20%-50%, it is an irrefutable fact that the balance of power is stacked against music retailers and labels.

Delivery fees charged by some foreign music distributors are often in high US dollar or Euro values and do not take into account the inability of retail partners to recoup this high upfront cost as a result of low retail pricing per unit in the respective market, though in recent times, the more enlightened distributors have been more flexible in Asia.

6) Due diligence on potential partners.

A standard upfront advance from a potential retail partner is always tempting for labels to seek – however, it can amount to blood money as the retail partner might not grow the market and could well be devaluing music in order to simply build traffic and increase valuation of the service provider or worse, cheating artists of their rightful royalties.

For example, EMI failed to conduct the necessary due diligence required of it and inexplicably partnered with infamous music infringer, Baidu in China. Expediency of this nature simply harms the market in the long run by emboldening illegal operators and inhibit others who are trying to build a viable market. There exists many Service Providers in Asia that use music to drive traffic to other more lucrative parts of their portal while others that simply build up their value in order to flip their companies or use music to sell devices. The record industry in the US has yet to dig itself out of the hole it got itself into as a result of being beholden to one of the largest tech firms in the world which uses music to sell its devices and the lessons are still not learnt well.

Choose trusted partners

Work with trusted partners instead of blindly licensing every operator in the market, which would inevitably include untrustworthy ones. This might mean that in the railroad track building phase in some markets, it might be necessary to work with a single trusted partner in an exclusive manner for a finite period in order to ensure stability and the bedrock for future success. Consider it the label’s investment in the market.

7) Lobby for the cessation of US/ European financial institutions’ support of pirate sites in Asia

Oftentimes, a lot of the piracy in Asia is funded by Western cash influx. For example, when institutions like Fidelity and Morgan Stanley are funding the likes of Baidu’s illegal mp3 activities as reported by The Register , then the battleground that international labels should focus on is their own backyard first.

8 ) Understand the legal framework and how to best utilize it

Content owners cannot expect the government to police their content online. For example, the law in many countries takes its lead from the DMCA and the Safe Harbour provision in the US which allows the proliferation of user generated content – and this has led to potential abuses by many websites. However, the law also states that a take-down notice needs to be served and complied with before liability of the content hosting company can be established. At the very least, labels and publishers should invest in basic resources to monitor and protect their content.

9) Understand business models and technology adoption in respective countries in Asia

Transplanting and applying Western licensing, sales and promotion models can be at odds with the Asian market. Micro-managing Asia from overseas headquarters by having its head up the proverbial posterior can be a huge problem. T.R. Harrington, CEO of Darwin Marketing, an online search marketing specialist based in Shanghai as reported by AdAge noted:

“When the core of your business is operating in mature markets with similar user habits, this strategy can work. However, applying this strategy to a rapidly developing, dynamic market with vastly different online behaviors spells disaster…..and a quick market exit”.

Labels, publishers and distributors should not apply the same rigid licensing models and fees to potential partners without first examining business models and their contribution to building a robust music distribution model in the target market in the long term. Strand Consulting highlighted that dissonance in the flow of information inhibits a better understanding of differing business models and technology adoption in countries beyond the American mothership.

“A great deal of the communication in the press will derive from the USA and be written by American media, who most often do not have their finger on the pulse regarding the telco world outside the USA. The total USA market is still only 7% of the global mobile market. We believe that a great deal of the press coverage that will attract global attention will be created in large international media, whereafter a great many smaller media will uncritically quote the international media. In our opinion there is an enormous difference between the mobile market in the USA and what Strand Consult is seeing in countries like Brazil, India, Kenya, China and large parts of Europe.”

By no means is the above a guarantee of success in the Asian market but will hopefully help cut through the endless chicken or egg debates on piracy vs lack of legal options. As TorrentFreak duly noted,

“Yet while millions flock to file-sharing networks and the knowledge on how to use them continues to spread, there is still a huge and largely untapped market out there, eager to funnel money through the official channels.“

There is also the possibility that the years of neglect have already eroded the market substantially, but without competitive alternatives for Asian consumers, unless labels face up to their Hobson’s choice and decide to give up the market for dead, then they are beholden to give it a proper shot. As Tim O’Reilly presciently stated in 2002:

“Services like Kazaa flourish in the absence of competitive alternatives. I confidently predict that once the music industry provides a service that provides access to all the same songs, freedom from onerous copy-restriction, more accurate metadata and other added value, there will be hundreds of millions of paying subscribers. That is, unless they wait too long, in which case, Kazaa itself will start to offer (and charge for) these advantages. (Or would, in the absence of legal challenges.)”

Mathew is the Vice-President of online music distributor R2G and independent music store, wawawa based in China